- Accurate Tax Rates Matter More Than Ever

- Quick Summary – Accurate Tax Rates Breakdown

- What’s New with Accurate Tax Rates

- Where Accurate Tax Rates Show Up

- Accurate Tax Rates Now Sync with Your Stack

- How to Use 4-Decimal Accurate Tax Rates in GHL

- Pro Tips for Accurate Tax Rate Success

- Accurate Tax Rates FAQ

- Why Accurate Tax Rates Matter for Agencies

- What’s Next for Accurate Tax Rates

- Accurate Tax Rates, Accurate Reporting

Accurate Tax Rates Matter More Than Ever

Tax compliance is no joke—and neither is sending your client a $1.78 tax line when it should’ve been $1.7826. It might seem like a small thing, but those fractional errors can snowball, especially for agencies handling recurring invoices, ecomm stores, or clients across multiple tax jurisdictions.

That’s why this update from GoHighLevel is such a big deal. Tax rates are now calculated and displayed with 4-decimal precision—finally giving you accurate tax rates that align with external systems and reduce rounding confusion.

For agency owners and white-labelers, this means cleaner books, fewer client questions, and exports that actually line up with Stripe, QBO, and Shopify.

Expect less rounding drama and more confidence in what you’re sending out.

This update ensures accurate tax rates with 4-decimal precision across all new GHL invoices, estimates, subscriptions, and exports. You’ll see better alignment with platforms like Stripe, QBO, and Shopify — plus fewer rounding issues and cleaner reporting.

Quick Summary – Accurate Tax Rates Breakdown

Purpose: To provide 4-decimal tax rate precision across GoHighLevel billing tools, reducing rounding discrepancies and aligning with external accounting platforms.

Why It Matters: Agencies and businesses working across different tax jurisdictions can now apply exact tax rates, improving accuracy and reducing client confusion.

What You Get: Accurate tax percentages (e.g., 7.1250%) across invoices, estimates, subscriptions, transactions, receipts, checkouts, and CSV exports.

Time to Complete: 2–5 minutes per setup. Works instantly on new records with no manual toggles or settings to adjust.

Difficulty Level: Very easy. Just input a tax rate as usual—GHL now handles the extra precision automatically.

Key Outcome: Cleaner financial records, export accuracy, and compliance confidence for agencies handling taxes at scale.

What’s New with Accurate Tax Rates

GoHighLevel has rolled out 4-decimal tax rate precision across key financial features—and it’s not just a UI change. This update enhances how tax percentages are calculated, stored, and displayed across your entire billing workflow.

Here’s what’s new:

Automate marketing, manage leads, and grow faster with GoHighLevel.

- 4-Decimal Tax Rate Display: You can now enter and see tax rates like 7.1250% instead of being limited to 7.13% or 7.12%. That means ultra-accurate tax application, especially in regions with fractional rates.

- Platform-Wide Coverage: The 4-decimal logic now applies to:

- Invoices and invoice previews

- Estimates

- Subscriptions

- Transactions

- Receipts

- Payment checkouts (Forms, Funnels, Stores, Links)

- CSV exports

- API responses

- No Change to Tax Amount Rounding: While the rate is now accurate to 4 decimals, the tax amount will still round to 2 decimal places to follow global currency standards. So you’ll see things like $1.78, not $1.7826.

This is a backend precision boost that ensures your tax rates display and calculate correctly from the first quote to the final receipt.

Where Accurate Tax Rates Show Up

The 4-decimal tax precision isn’t just buried in the backend—it’s showing up loud and clear across your GoHighLevel platform.

Here’s where you’ll see the changes in action:

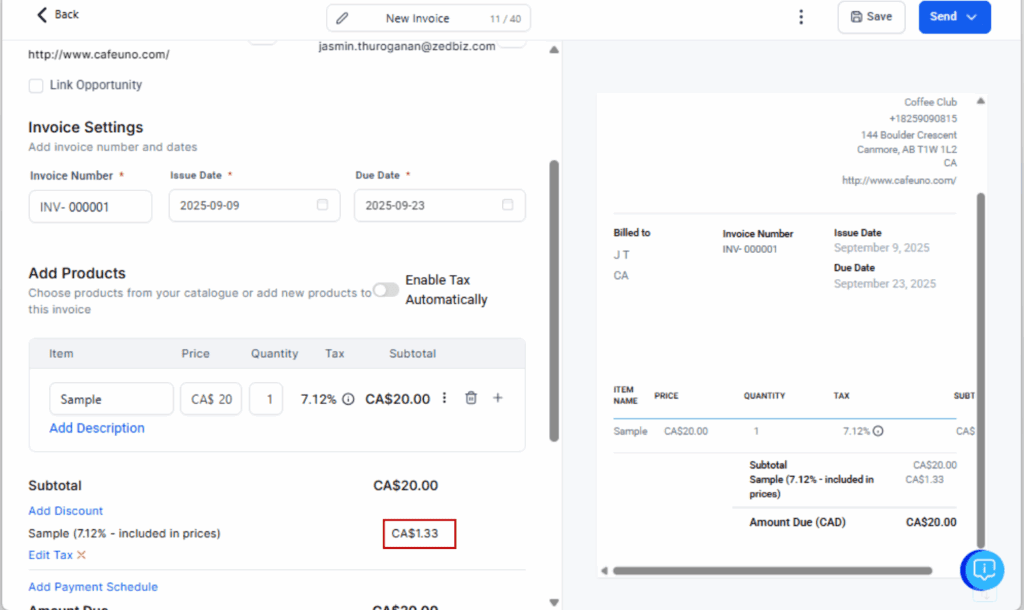

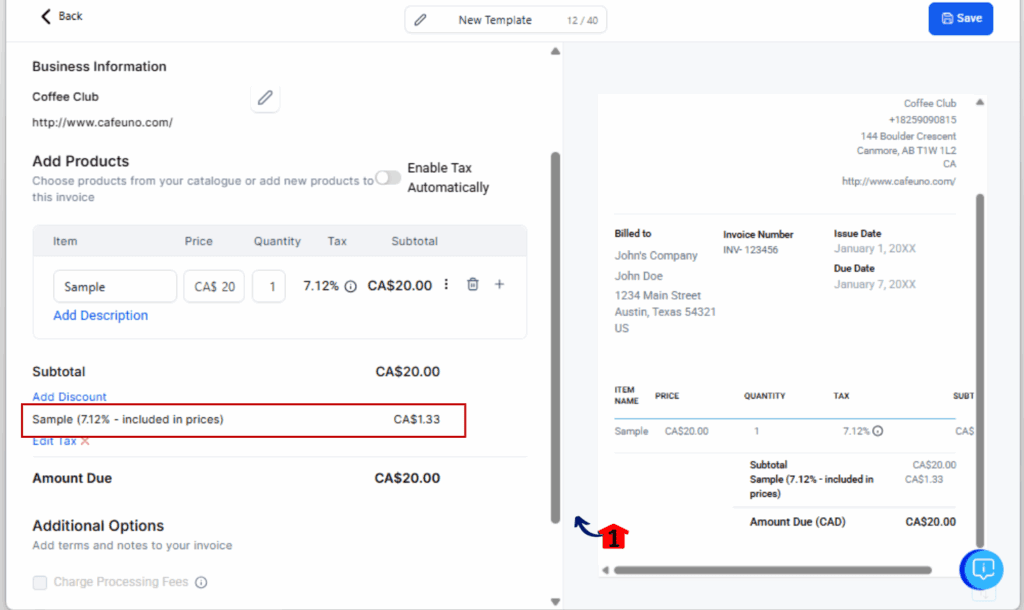

- Invoices: Whether you’re building new ones or previewing them before sending, tax rates now show up with 4 decimal places. Exports? Also covered.

- Estimates: Same deal. When quoting clients, your tax math will finally match the real-world rate—no more explaining fractional weirdness.

- Transactions: Payment logs and transaction breakdowns now reflect the new tax rate precision.

- Subscriptions & Receipts: Recurring invoices tied to subscriptions now show more accurate tax rates, helping clients trust what they’re being charged.

- Checkouts: Every place you collect payments—Forms, Funnels, Stores, Payment Links—will now include 4-decimal tax rate visibility in the tax breakdown section.

- Exports: CSV exports of invoices, transactions, subscriptions, and orders now include 4-decimal tax rates for cleaner accounting.

In the API world? Tax rates are now also exposed in 4-decimal format in API responses, so your custom reporting or integrations don’t fall behind.

Whether you’re dealing with a one-time invoice or recurring charges, GoHighLevel has made sure every number on-screen matches the math behind it.

Accurate Tax Rates Now Sync with Your Stack

If you’re managing accounting workflows across platforms, this part’s for you.

The new 4-decimal tax rate precision isn’t just a GHL-only upgrade—it’s been validated to play nice with the big external systems your agency or clients are probably using.

Here’s who’s already onboard:

- QuickBooks Online (QBO): Now sees and syncs tax rates like 7.1250% without rounding mismatches in your exports or imported invoices.

- Stripe: If you’re running SaaS mode or subscriptions via Stripe, your tax rates now display consistently across both platforms.

- Shopify: Ecomm agencies will love that exported order data with fractional tax rates now aligns with Shopify’s calculations.

Whether you’re importing or exporting invoices, orders, transactions, or subscriptions—4-decimal precision holds up on both sides.

You’ll avoid sync errors, eliminate double-checking every tax line, and make your accountant a little less cranky.

How to Use 4-Decimal Accurate Tax Rates in GHL

If you’ve ever had to explain why a client’s tax rate looks different from their local jurisdiction or why Shopify and GHL exports didn’t match, this update is your fix. Now that 4-decimal tax rates are live in GHL, your invoices, estimates, and transactions can finally match the precision your accounting tools expect. Here’s how to start using it.

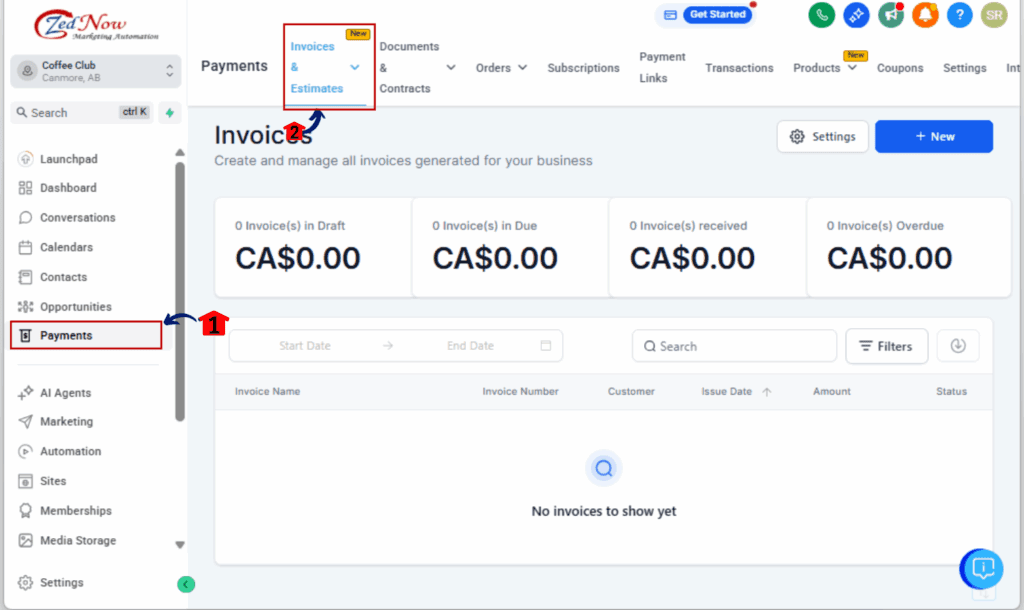

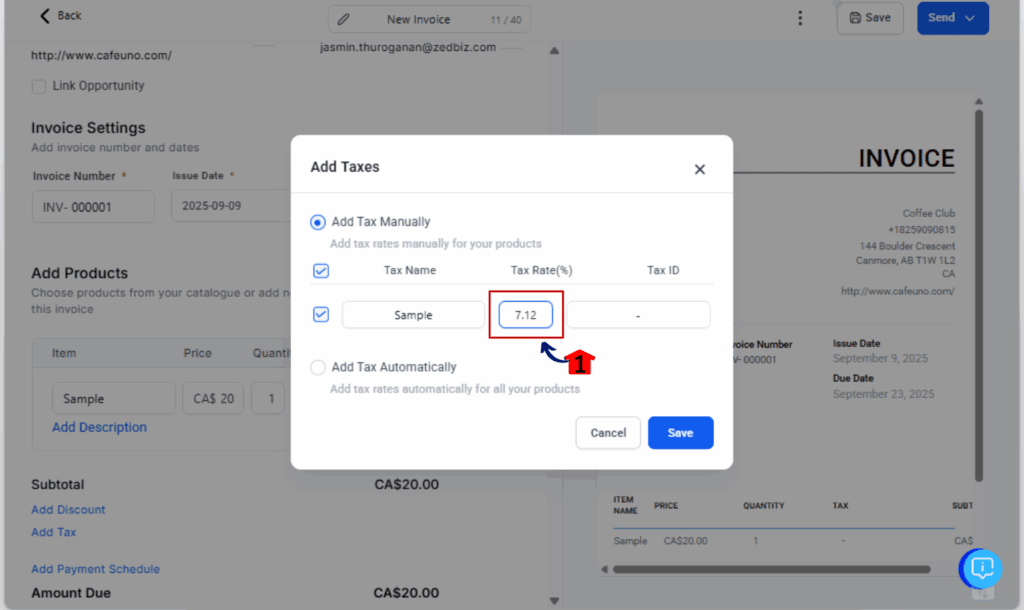

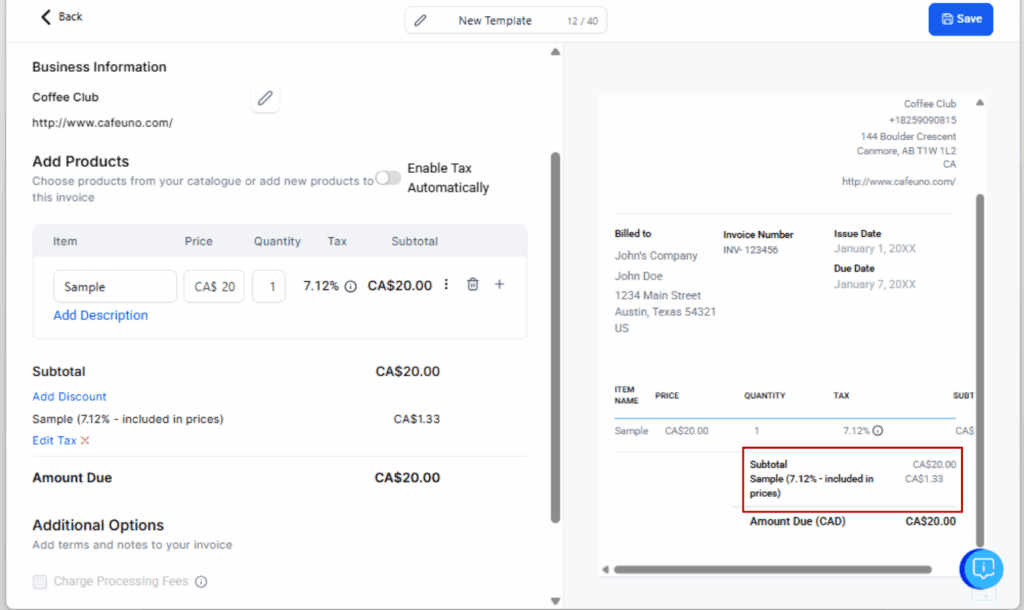

Step 01 – Create a New Invoice or Estimate

1.1 Navigate to Payments > Invoices or Payments > Estimates

1.2 Click + New or open an existing draft

1.3 Add a line item and click + Tax

1.4 Enter a 4-decimal tax rate (e.g., 7.1250%)

1.5 Preview and send – the UI will now show the full tax rate

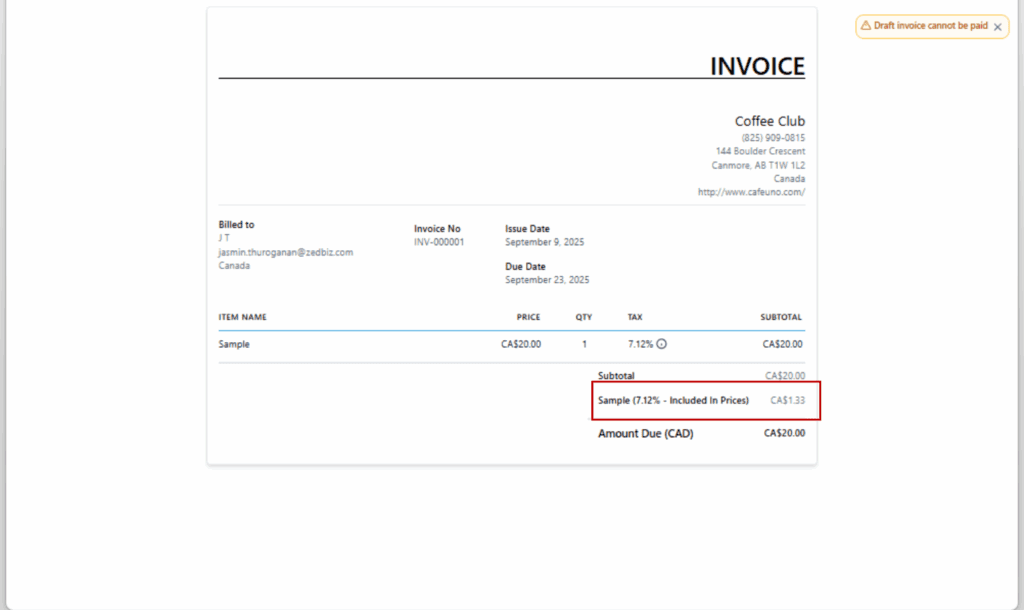

Step 02 – Confirm 4-Decimal Rates in Client-Facing Docs

2.1 Open the sent invoice, estimate, or receipt

2.2 Check the tax rate section – it will show as X.XXXX%

2.3 The tax amount (e.g., $1.33) will still round to 2 decimals as per currency standards

Step 03 – Validate in Exports and APIs

3.1 Open the file and verify the tax rate column now reflects 4 decimal places

3.2 API users will see the same updated tax rate data in responses

Step 04 – Understand Backward Compatibility

4.1 Only newly created records after the update will use 4-decimal logic

4.2 Existing invoices or signed contracts will stay as-is for historical integrity

4.3 There’s no retroactive change—this is by design for accuracy and compliance

That’s it. You’re now running precision-level tax workflows that align with your external systems, impress your accountant, and reduce compliance risk.

Pro Tips for Accurate Tax Rate Success

Now that you’re using 4-decimal tax rates like a pro, here are a few ways to make sure everything runs smoothly across your agency workflows and client accounts.

Audit Your Existing Tax Templates

- Go into any pre-set invoice or estimate templates.

- If you previously saved a 2-decimal tax rate, consider updating it to match your jurisdiction’s full 4-decimal precision.

Update Your Default Workflows

- Using automations to trigger invoices, subscriptions, or order receipts?

- Double-check any static tax fields or values in your workflows.

- Make sure your taxes aren’t being hard-coded with 2-decimal approximations.

Use Exports for Cross-System Accuracy

- If you’re syncing data into accounting tools like QBO, Stripe, or Shopify, this update means you can finally rely on direct CSV exports without manually adjusting rates.

- Using the same tax rate everywhere helps you avoid mismatches when it’s time to close the books.

Communicate the Change to Clients

- If your clients regularly review estimates or invoices, let them know about the increased precision.

- This helps build trust, especially with recurring billing or tax-sensitive industries.

Keep an Eye on Mobile POS

- If you’re using mobile invoicing or POS features, know that 4-decimal tax support is coming next.

- For now, desktop and web exports are fully supported.

Small steps here = big wins later when audits, syncs, or client questions come up.

Accurate Tax Rates FAQ

Still got questions? Here’s what agencies and users are asking now that 4-decimal tax precision is live in GoHighLevel.

Why Accurate Tax Rates Matter for Agencies

If you’re running an agency, accuracy in billing isn’t just a nice-to-have—it’s how you keep your clients confident, your exports clean, and your compliance tight.

This 4-decimal tax update might feel technical, but here’s why it matters:

It Prevents Costly Rounding Errors

In industries where every decimal counts, a small tax rate gap can snowball. This change helps you stay accurate from the start.

It Reduces Questions From Clients

When invoices show the same tax rates clients are used to seeing locally (like 7.1250%), there’s less back-and-forth explaining why things “look off.”

It Aligns With Accounting Standards

Now your GHL invoices and exports match the precision requirements of tools like QBO, Stripe, and Shopify—making reconciliations smoother and less error-prone.

It Future-Proofs Your Financial Stack

Whether you’re white-labeling GHL or managing multiple sub-accounts, this update ensures you’re tax-accurate at scale and across integrations.

It Builds Trust

The more precision your systems show, the more professional and trustworthy your agency looks to clients, bookkeepers, and auditors.

Bottom line: small decimal changes = big credibility gains.

What’s Next for Accurate Tax Rates

The 4-decimal tax precision update is already live across the GoHighLevel web platform—but that’s not where it ends.

Mobile POS Support Is Coming Soon

If you’re using GoHighLevel’s mobile app for point-of-sale (POS) transactions, you’ll soon get the same 4-decimal tax rate precision on invoices generated from mobile devices.

This is a big win for:

- Agencies supporting field-based businesses

- Coaches, consultants, or service pros collecting payment on-the-go

- Anyone using mobile invoicing where tax compliance still matters

Keep an Eye on Changelog & Mobile Updates

The mobile team is already working on full tax rate support for the POS workflow. You’ll get the same accuracy on your phone as you do on desktop, making it easier to keep client billing aligned no matter where it’s triggered from.

Until then, the 4-decimal support is fully active on all desktop workflows, exports, and APIs.

Accurate Tax Rates, Accurate Reporting

This might look like a behind-the-scenes update—but it delivers front-and-center value for every GHL user dealing with tax-heavy workflows.

You now have 4-decimal tax rate support across:

- Invoices

- Estimates

- Transactions

- Subscriptions

- Checkouts

- Exports

- API responses

That means fewer rounding errors, better tax compliance, and smoother syncs with your accounting stack. Whether you’re invoicing clients, exporting data to QuickBooks, or reconciling Shopify orders, this update keeps your tax rates sharp and your reports audit-ready.

Try it today:

Open a new invoice or estimate and punch in a tax rate like 7.1250%—you’ll see it all the way through the workflow, from client preview to export file.

Accuracy builds trust. Now your invoices do too.

Scale Your Business Today.

Streamline your workflow with GoHighLevel’s powerful tools.