- Why flexible billing is a game-changer

- Quick Summary – Custom Payment Gateway

- What’s new with custom payment support

- What’s changed from the old setup

- Why custom payment gateways matter

- How to Use a Custom Payment Gateway in SaaS Mode

- Pro tips for using custom payment gateways

- What this means for your agency

- Results you can expect from this update

- FAQs about custom payment gateways

- Start using a custom payment gateway today

Why flexible billing is a game-changer

Still stuck using Stripe for SaaS billing? That ends now. Custom payment gateway is here.

GoHighLevel just unlocked full support for custom payment gateways inside SaaS Mode and it changes everything. Whether you’re in a country where Stripe isn’t supported, or you’ve been itching to use a regional provider that better fits your business, this update gives you the green light to launch, grow, and monetize without limits.

With over 50+ providers available in the App Marketplace, you can now use your preferred custom payment gateway to onboard clients, automate subscriptions, recharge wallets, and even resell add-ons like WordPress or the AI Employee.

This isn’t a minor tweak, this is a major move toward making GHL truly global.

Using a custom payment gateway in SaaS Mode lets you expand internationally, accept local payments, automate billing, and monetize add-ons, all without touching a single line of code.

Quick Summary – Custom Payment Gateway

Purpose: To help GHL agency owners use a custom payment gateway instead of Stripe for SaaS Mode billing and subscriptions.

Why It Matters: Stripe-only billing limited where and how agencies could sell. Now, with 50+ custom payment providers, SaaS Mode becomes truly global.

What You Get: Seamless onboarding, localized payments, recurring billing (if supported), wallet top-ups, and add-on monetization — all integrated in GHL.

Time To Complete: Initial setup can be done in under 30 minutes once your payment provider is connected.

Difficulty Level: Beginner to intermediate — no coding required, but some knowledge of your billing flow helps.

Key Outcome: Global SaaS expansion, higher conversion rates, more revenue streams, and fewer billing headaches.

What’s new with custom payment support

This update brings one of the most requested features to life: the ability to run SaaS Mode with your choice of payment provider.

GoHighLevel now lets you connect a custom payment gateway from the App Marketplace — opening the door to more than 50+ integrations that fit local currencies, regional regulations, and specific business needs.

Automate marketing, manage leads, and grow faster with GoHighLevel.

Here’s what’s been added:

- Custom Provider Support: You’re no longer tied to Stripe. You can choose from dozens of options including PayPal, Razorpay, Mollie, and more.

- Automated SaaS Onboarding: Clients are onboarded instantly. The system creates their sub-account, attaches their plan, and activates billing at checkout — hands-free.

- Recurring Billing Support: If your chosen gateway supports it, you can enable recurring charges for subscriptions.

- Wallet Top-Ups: Support for both manual and automatic wallet recharges, giving you more flexibility in how clients pay for extras.

- Add-On Reselling: You can now sell features like AI Employee, WordPress, and Marketplace apps. Fees are auto-deducted from the client’s wallet.

If you’ve ever felt boxed in by Stripe, this opens the door wide.

What’s changed from the old setup

Before this update, SaaS Mode inside GoHighLevel only worked with Stripe. If Stripe wasn’t available in your country or didn’t support your preferred currency, you were stuck. Some agencies tried complicated workarounds or gave up on using SaaS Mode altogether.

Now, it’s a different story.

Here’s what’s different:

- From Stripe-Only to 50+ Gateways: You can now choose a payment provider that works for your region, your bank, and your clients.

- Checkout to Sub-Account Automation: The entire process — from purchase to sub-account creation to SaaS plan activation — is now fully automated even with custom gateways.

- Wallet-Based Billing: Clients can prepay (manually or automatically) and have wallet balances that cover add-ons and usage-based features.

- Add-On Monetization: You’re not just selling a SaaS plan anymore. You can sell add-ons like the AI Employee, WordPress hosting, or Marketplace apps and automatically bill clients from their wallets.

This is a foundational shift, from being locked into a single provider to building your own localized billing stack with just a few clicks.

Why custom payment gateways matter

For agencies outside Stripe’s supported countries or even just those dealing with limited payment options, this update is a total unlock.

Here’s why using a custom payment gateway in SaaS Mode matters:

- Global Expansion Becomes Real: You can now run SaaS Mode in regions like India, Southeast Asia, Africa, and parts of Europe where Stripe is unavailable or limited. Local gateways like Razorpay, Paystack, or Mollie become viable options.

- Local Currencies, Higher Conversions: Clients can pay in their own currency. That alone reduces friction, boosts trust, and increases the likelihood they’ll convert on checkout.

- No More Workarounds or Hacks: Before, you might have had to duct-tape together a payment form and manual onboarding. Now? Everything is connected inside GHL — automated and scalable.

- Add-On Monetization Without Extra Tech: You can sell extras like AI tools, Marketplace apps, or even hosting add-ons directly and deduct from a client’s wallet without manual invoicing.

- SaaS, Your Way: This puts control back in your hands. Pick your gateway, define your model, and go to market how you want, not how your billing provider dictates.

This update isn’t just about payments. It’s about agency freedom, scalability, and localization, all wrapped into one feature.

How to Use a Custom Payment Gateway in SaaS Mode

This update opens the door to global SaaS billing. Forget Stripe restrictions, choose your own payment gateway, get paid anywhere, and offer add-ons without hiring a developer. Here’s how to get started in just a few steps.

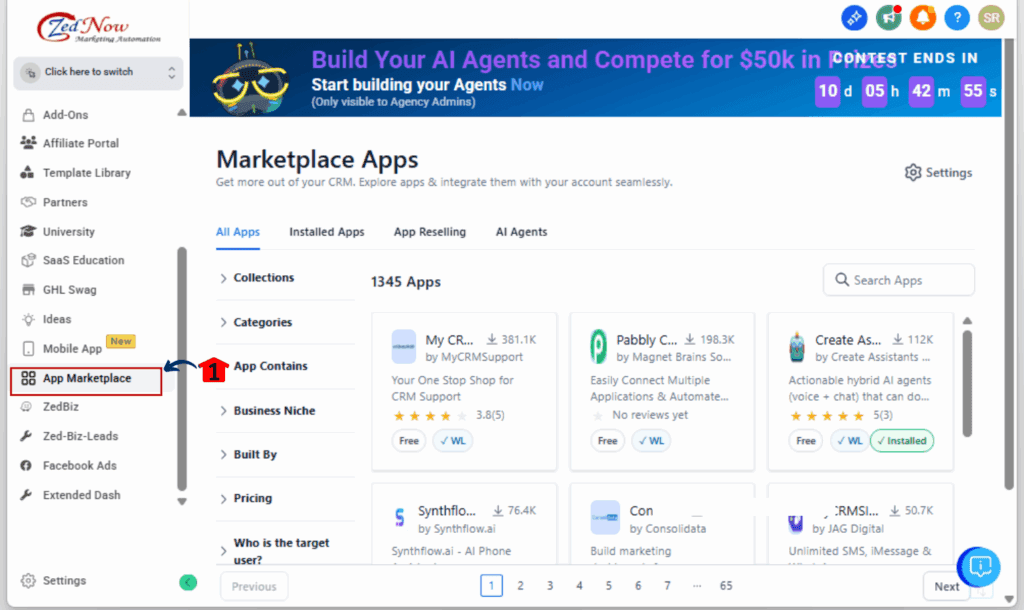

Step 01 – Open the App Marketplace

1.1 From your GHL Agency Dashboard, go to the left-hand menu.

1.2 Click on App Marketplace.

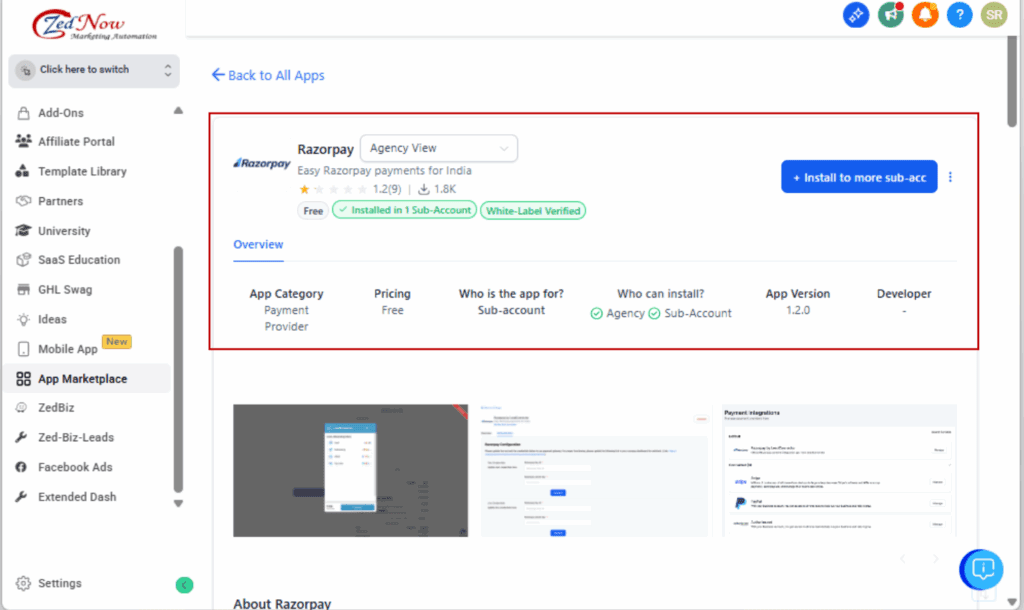

1.3 Search for your preferred payment provider (e.g., Razorpay, Mollie, PayPal, etc.).

1.4 Click Connect and follow the provider’s instructions to authorize the integration.

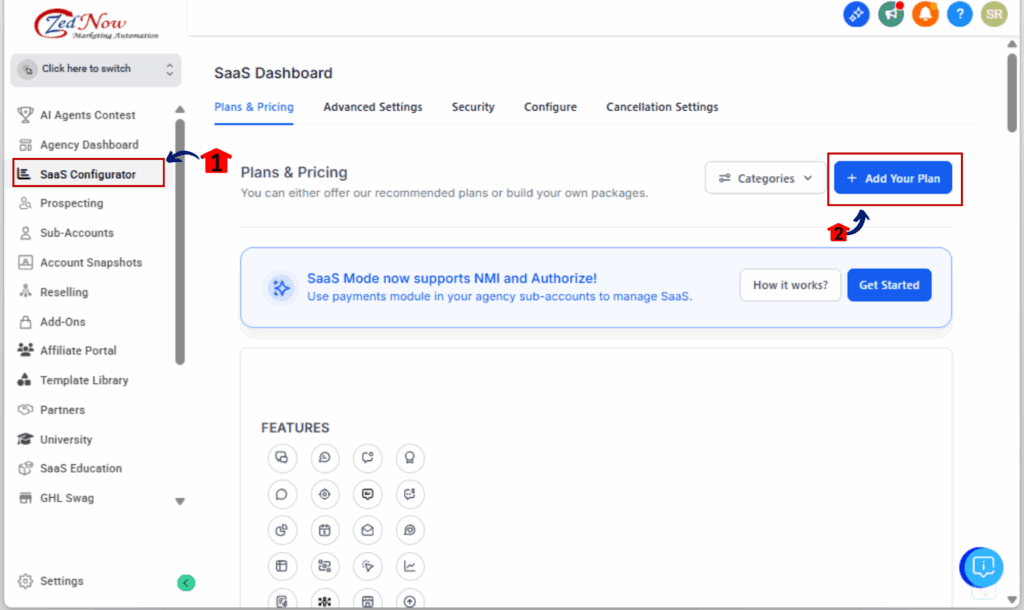

Step 02 – Create Your SaaS Plans

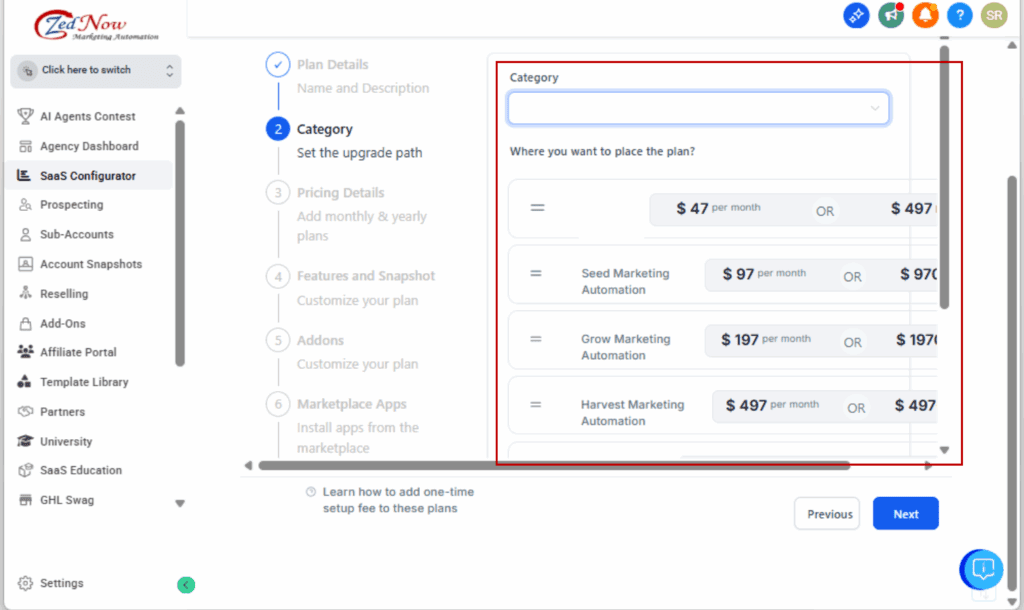

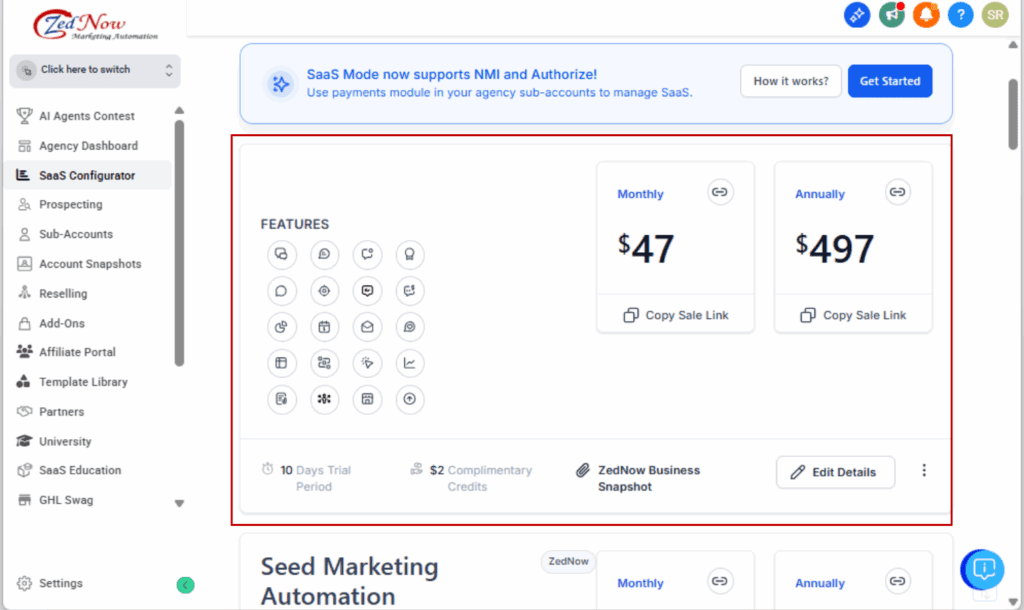

2.1 In the SaaS Configurator, click on Plans.

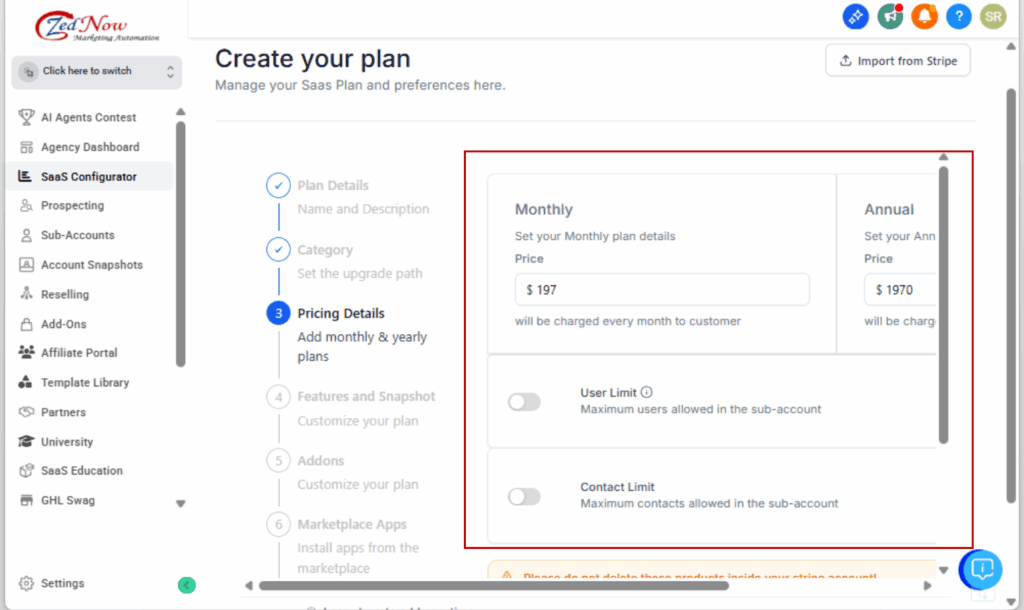

2.2 Set up your pricing tiers (Startup, Pro, etc.).2.2 Set up your pricing tiers (Startup, Pro, etc.).

2.3 Assign the payment provider for each plan (you’ll now see options beyond Stripe).

2.4 Define usage limits, included features, and automation triggers.

Step 03 – Set Up Wallet Billing

3.1 Navigate to Wallet Settings in the SaaS Configurator.

3.2 Decide if clients should add funds on their own or if their wallets should refill automatically.

3.3 Set thresholds, recharge amounts, and low-balance alerts.Then, set when alerts should go out and how much should be added.

3.4 This enables automated charges for add-ons and usage-based billing.

Step 04 – Enable and Price Add-Ons

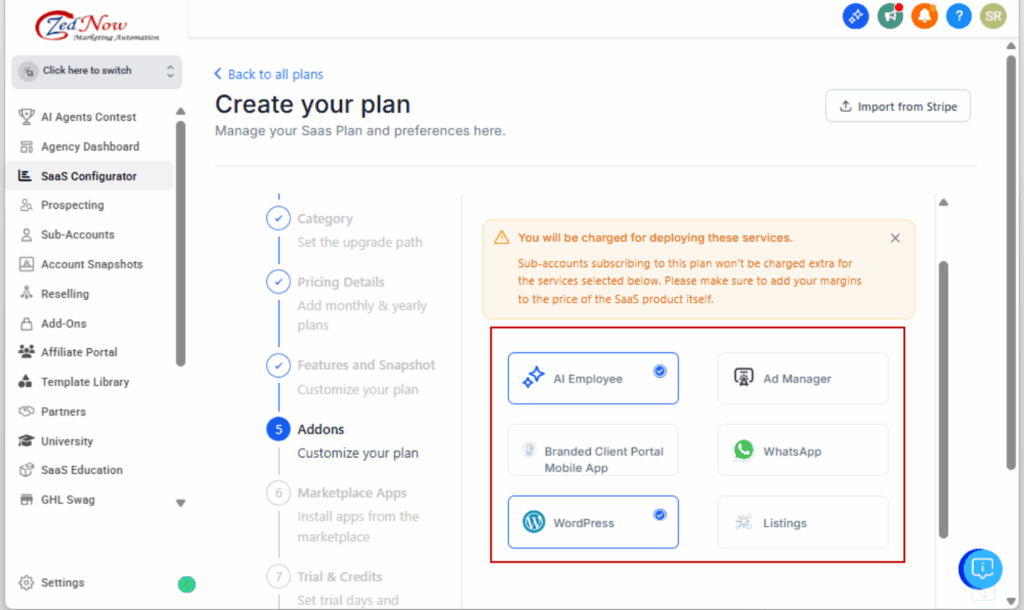

4.1 Go to the Add-Ons section under SaaS Configurator.

4.2 Toggle on services like WordPress, AI Employee, or Marketplace Apps.

4.3 Enter your custom pricing per add-on.

4.4 Choose to deduct from the client’s wallet balance automatically.

Step 05 – Launch and Scale

5.1 Start sending traffic to your funnel.

5.2 Onboard clients from any country that supports your chosen gateway.

5.3 Monitor client usage, automate wallet charges, and grow!

That’s it. With your custom payment gateway integrated, you’re free to launch SaaS globally, with localized billing, flexible monetization, and no tech bottlenecks.

Pro tips for using custom payment gateways

Now that you’ve got your custom payment gateway live, here are some smart tips to keep everything running smoothly.

Use providers that support recurring billing

Some payment providers can’t handle recurring charges. If you’re offering monthly or yearly plans, double-check that yours supports automatic billing—even when your client isn’t online. Stripe, PayPal, and Mollie are solid. Razorpay? Not so much.

Use wallet top-ups to work around limitations

If your gateway doesn’t support recurring billing, no problem. Just use the wallet feature. Clients can manually or automatically top up their balance, and you can deduct monthly usage and add-ons from it. This keeps things seamless on the backend even if your provider is limited.

Bundle Add-Ons for more revenue

You’re not just selling SaaS access — now you can bundle in extras like WordPress hosting, AI Employees, and third-party apps. Use the Add-Ons feature to price these out and auto-charge from the wallet. It’s an easy upsell.

Set wallet recharge alerts

Want to avoid “oops” moments when a wallet runs dry? Use wallet low-balance notifications to alert clients (and you) when funds are getting low. You can also set minimum balances to prevent service interruptions.

Keep things simple for the client

Your clients don’t care about the tech — they just want things to work. Customize your funnel to clearly explain pricing, wallet top-ups, and the value of add-ons. Use email or WhatsApp alerts to confirm wallet charges and add-on activations.

What this means for your agency

This isn’t just a feature drop — it’s a total shift in how you can operate your SaaS business globally.

With custom payment gateway support, agencies can now:

Go Global Without Stripe

Stripe used to be the gatekeeper. If your country didn’t support it, you were stuck. Now, you can use Mollie in the EU, Razorpay in India, or Paystack in Africa — no VPNs, no hacks, just clean billing.

Tap Into Local Payment Culture

Some countries don’t trust cards. Some prefer bank transfers or digital wallets. By choosing a local provider, you meet your clients where they are — and that boosts conversion.

Productize and Monetize Everything

You can turn your services into products: sell AI Employees, add-on apps, or WordPress sites — and automatically deduct the charges. This creates more predictable MRR and opens new revenue streams.

White-Label Without Limits

This update works beautifully with snapshots and resellers. You can now bundle a full SaaS + billing stack, localized to the region, and hand it to a white-labeled partner or franchise.

Serve Niches With Unique Needs

Some niches (government, medical, legal) have strict billing requirements. Being able to choose your provider gives you the flexibility to meet those demands — and win deals your competitors can’t touch.

This update removes excuses and unlocks new paths — for growth, revenue, and reach.

Results you can expect from this update

Implementing a custom payment gateway in your GHL SaaS setup doesn’t just solve technical issues — it directly impacts your bottom line.

Here’s what you can expect once you make the switch:

More Sales From Untapped Markets

If Stripe blocked you from selling in certain regions, that wall is gone. You can now sell to clients in India, Africa, Southeast Asia, Europe, and anywhere your chosen gateway supports.

Higher Conversion Rates

When clients can pay in their local currency — using their preferred method — you remove friction. That leads to faster checkouts, fewer abandoned carts, and more sign-ups.

Reduced Support Tickets Around Billing

Stripe issues? Card declines? Unsupported currencies? Those headaches drop dramatically when you switch to a localized provider that understands the region.

Simplified Add-On Sales

Before, selling extras meant sending manual invoices or using clunky Stripe webhooks. Now, clients preload their wallet and you deduct for any add-on they buy. Simple. Scalable. Automated.

Faster Time to Market

You don’t need to wait for Stripe approval or workaround setups. Pick a gateway, connect it in the Marketplace, and launch your SaaS globally — fast.

This update isn’t just about features — it’s about real business outcomes: more clients, more revenue, and fewer roadblocks.

FAQs about custom payment gateways

Start using a custom payment gateway today

This update removes the single biggest bottleneck for agencies trying to scale SaaS Mode globally: payment flexibility.

You no longer need to wait for Stripe approval. You don’t have to tell clients they can’t use their local gateway. And you definitely don’t need to hack together a workaround that breaks with every update.

With GoHighLevel’s support for custom payment gateways, you can:

- Launch SaaS anywhere in the world

- Accept payments in local currency

- Automatically onboard clients

- Monetize add-ons with wallet deductions

- And scale without tech drama

If you’ve been sitting on the sidelines waiting for Stripe alternatives, this is your moment.

Go to the App Marketplace. Pick your provider. Turn on SaaS Mode. And get paid — your way.

Scale Your Business Today.

Streamline your workflow with GoHighLevel’s powerful tools.